What is Business Banking?

Business banking encompasses the array of services that financial institutions provide specifically for businesses.

Moniepoint Business Banking

These services include loans, checking and savings accounts, credit options, financial advisory, and much more.

Key Takeaways

Financial institutions offer business banking services to help entrepreneurs effectively manage their cash flow.

Business banking provides a variety of services, including loans, savings and checking accounts, along with financial advice.

Moniepoint MFB ranks among Nigeria’s largest fintech companies, delivering business banking solutions to both small and large enterprises, including capital loans, CAC registration services, and savings and current accounts.

Nigeria hosts roughly 40 million micro, small, and medium-sized enterprises (MSMEs), with around 89.4% operating within the informal sector.

You may have just launched your dream business or been running it for a while, and your profits might be soaring.

Exciting, right? However, to ensure your earnings are safely stored or reinvested, having a business bank account is crucial.

Business banking offers numerous advantages, such as improved organization and accurate tracking of your financial transactions.

Features of Business Banking

What should you expect from a business banking service? Here are some specific characteristics of business banking:

What should you expect from a business banking service? Here are some specific characteristics of business banking:

- Business Accounts

Business banking institutions like Moniepoint MFB provide business accounts that facilitate effective cash flow management.

These accounts streamline daily operations, such as processing customer payments and purchasing goods. Additionally, business savings accounts allow you to set aside earnings for future projects or expenses.

One significant advantage of maintaining this account is the clear separation it creates between your business finances and personal funds, particularly useful during tax season.

- Business Loans and Credit

Capital is essential for any business, as access to funds promotes growth and expansion. However, acquiring financing can be challenging, especially for informal businesses. This is where business banking services from institutions like Moniepoint become invaluable.

Did you know that about 70.1% of Nigerian business owners in the informal sector rely on loans for operational expenses, often borrowing from friends and family?

Having a business bank account makes it easier to obtain loans and credit from financial institutions.

Cash Management and Employee Payroll Services

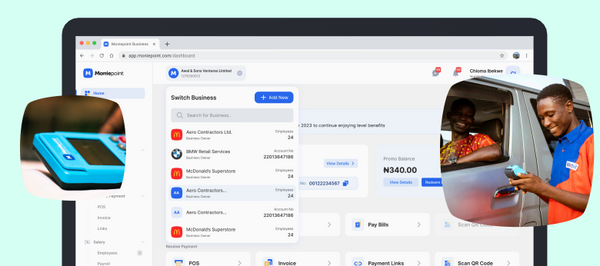

As a business owner, utilizing cash management tools provided by financial institutions helps you accurately track the inflow and outflow of your funds. Many institutions also offer payroll services that enable you to manage and compensate your employees promptly and efficiently.Payment Processing

Most businesses accept various payment methods, including debit cards and mobile payments.

Digital payments, which encompass card and mobile transfers, represent over 46.2% of the payments made by business owners in Nigeria’s informal sector.

Furthermore, business banking services include payment solutions using POS systems or payment gateways, allowing you to accept customer payments seamlessly.

- Online or Mobile Banking

In today’s digital landscape, online banking has become a necessity. Most business, commercial, and retail banks offer diverse mobile and web-based banking services that allow business owners and individuals to conveniently access financial services.

The ability to make transfers and receive payments from anywhere in the world ensures smooth business operations and growth.

Types of Business Accounts

Understanding the various types of bank accounts available will help you select the right business banking services to meet your specific needs.

- Current or Checking Account

A business checking account enables merchants to conduct everyday financial activities such as making deposits, receiving payments, and monitoring finances. Business current accounts allow for withdrawals through checks, drafts, and various online banking methods.

2. Business Savings Account

A business savings account lets you save your business funds for future investments or unforeseen expenses. You can earn interest on this account, helping you grow your cash reserves while keeping your money secure.

3. Merchant Accounts

If you sell goods or services and process debit card or online payments, you will likely need a merchant account. This account allows you to receive customer payments, which are temporarily stored in this specialized account before being transferred to your primary account after verification.

What to Consider When Choosing a Business Bank Account

When selecting a business bank account, consider the following tips:

1. The Size of Your Business

Your business size influences the type of account you should choose. Smaller businesses may benefit from a basic current bank account to minimize charges and fees. In contrast, larger businesses with higher transaction volumes might opt for accounts that offer a broader range of services.

2. Charges and Fees

Pay close attention to the service charges associated with various bank accounts, which may include monthly and per-transaction fees. It’s vital to select a bank that offers fees that align with your financial capacity.

3. Your Financial Needs

Consider your business’s specific requirements when choosing banking services. For example, does your business need check writing, debit cards, online banking capabilities, etc.?

Understanding your needs is essential for selecting a bank account that offers the necessary services and meets your business requirements.

Conclusion

Business banking is crucial for your growth as it helps you accurately track and manage your finances.

You Might also like

-

Small Businesses Ideas

The Big Oxmox advised her not to do so, because there were thousands of bad Commas, wild Question.

-

Get Funding for Your Business

Effective Strategies to Secure Funding for Your Business

Every successful business begins with a compelling idea—a solution designed to address specific customer needs. Whether operating as a brick-and-mortar establishment or an online enterprise, the journey of turning that idea into a thriving business often hinges on one critical factor: funding.

For many small businesses, particularly in developing regions like Nigeria, accessing the capital needed to grow and sustain operations is a significant challenge. The International Finance Corporation (IFC) estimates that about 40% of micro, small, and medium enterprises (MSMEs) in such regions face an annual funding gap of $5.2 trillion.

If you’re looking for actionable ways to secure funds for your business—be it through personal resources, loans, or alternative financing options—this guide is for you.

Identifying Your Business Funding Needs

Before seeking funding, it’s crucial to pinpoint your financial requirements. Are you at the startup stage or preparing for expansion? Clarify the purpose of the funds and create a list separating immediate needs from those that can wait. This approach will help you manage debt wisely and set realistic expectations.

Conduct a cash flow analysis to determine how much money you need to reach your next business milestone. Typical expenses to consider include:

- Payroll: Decide how many employees you need, what to pay them, and when their contributions will begin generating profits.

- Licenses, taxes, and permits: Understand regulatory requirements and budget accordingly.

- Insurance: Protect your business and employees against unforeseen events.

- Inventory: Assess and plan for adequate stock levels.

- Marketing and web presence: Allocate funds for advertisements and website maintenance to boost visibility and revenue.

- Operational costs: For physical locations, plan for rent, equipment, and utilities. Review lease terms thoroughly to avoid surprises.

Every successful business begins with a compelling idea—a solution designed to address specific customer needs. Whether operating as a brick-and-mortar establishment or an online enterprise, the journey of turning that idea into a thriving business often hinges on one critical factor: funding.

For many small businesses, particularly in developing regions like Nigeria, accessing the capital needed to grow and sustain operations is a significant challenge. The International Finance Corporation (IFC) estimates that about 40% of micro, small, and medium enterprises (MSMEs) in such regions face an annual funding gap of $5.2 trillion.

If you’re looking for actionable ways to secure funds for your business—be it through personal resources, loans, or alternative financing options—this guide is for you.

Types of Business Funding

Business financing generally falls into two categories:

Zero-Debt Financing

This involves funding your business through personal savings or investments from others, often in exchange for equity or other incentives. This option works well for startups aiming to avoid early-stage debt.Debt Financing

This entails borrowing money with a commitment to repay it along with interest. Before taking this route, ensure you have a detailed business plan, including market research, financial projections, and revenue strategies.

Practical Funding Options for Your Business

1. Personal Savings (Bootstrapping)

This approach allows you to fund your business using your personal resources. While it minimizes the risks of incurring debt, it’s most suitable for smaller-scale ventures or early-stage operations. For businesses planning to scale, additional external funding might become necessary.

2. Friends and Family Support

Borrowing from friends and family is a popular way to fund startups. Transparency is key—clearly communicate your goals and financial plans. Treat these contributions with the same professionalism as investments from external sources. Define whether the money is a loan, an equity investment, or a gift to avoid misunderstandings later.

3. Equity Financing: Venture Capital and Angel Investors

Equity financing involves exchanging a share of your business for financial support. Angel investors are more inclined to back smaller ventures, while venture capitalists typically invest in rapidly growing companies with significant revenue potential. Ensure all agreements are clearly outlined to avoid future conflicts.

4. Business Loans

For businesses unable to secure loans from traditional banks, microfinance institutions offer a viable alternative. For instance, Moniepoint provides loans tailored to small business needs, leveraging financial data and credit assessments to facilitate access to working capital.

5. Government Grants

Government bodies, such as the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN), often provide grants for business development and research. While these funds are non-repayable, the application process can be competitive and time-consuming. Be prepared with a detailed business plan and supporting documents.

6. Crowdfunding

Crowdfunding allows businesses to raise funds from a large pool of supporters. Options include:

- Equity Crowdfunding: Donors receive a share in the business.

- Rewards-Based Crowdfunding: Supporters contribute in exchange for non-monetary rewards like exclusive product access.

- Debt-Based Crowdfunding: Contributors offer loans, repaid with interest on a set schedule.

To succeed in crowdfunding, conduct market research and craft a compelling pitch that resonates with potential supporters.

Leveraging Moniepoint for Business Loans

Moniepoint simplifies the process of obtaining business loans by focusing on small enterprises’ unique financial dynamics. With flexible eligibility requirements and efficient loan processing, Moniepoint is an excellent choice for businesses needing accessible funding options.

Key Features of Moniepoint Loans

- Business loans tailored for working capital and overdrafts.

- Eligibility requires an active Moniepoint business account used consistently for at least six weeks.

- Minimal documentation: only a CAC certificate or shop rent receipt is needed in most cases.

- Quick application process with loans processed within 24–72 hours.

- Flexible loan tenures ranging from 12 to 24 weeks.

Take the Next Step

Securing funding for your business can be a challenging process, but with the right strategies and resources, it’s achievable. Whether you’re exploring personal financing, loans, or alternative funding options, understanding your financial needs and aligning them with appropriate funding sources is the key to sustainable growth.

Start today by assessing your business goals and taking advantage of opportunities like Moniepoint’s tailored financial solutions.

Post Views: 196 -

What Is PND In Moniepoint

The Big Oxmox advised her not to do so, because there were thousands of bad Commas, wild Question.