How to Recharge Your Prepaid Meter (2024)

Congratulations! You finally have a prepaid meter. No more headaches from those frustrating “estimated bills” that drained your wallet. With a prepaid meter, you now have total control over your electricity consumption.

Wondering how to recharge it? No worries, I’ve got you covered. In this guide, we’ll go over the easiest ways to recharge your prepaid meter, how to get one installed, and how to maximize its benefits.

One of the greatest perks of using a prepaid meter is that it lets you track your spending and make smarter financial decisions. This is especially useful in today’s economy!

How to Load Your Prepaid Meter and Pay Postpaid Electricity Bills

Recharging your prepaid or postpaid meter has never been easier, thanks to Moniepoint. Follow these simple steps to get it done:

- Head over to the Google Play Store or Apple App Store and download the Moniepoint mobile app.

- After installing the app, create an account if you’re new. If you’re already a user, simply log in to your Moniepoint bank account.

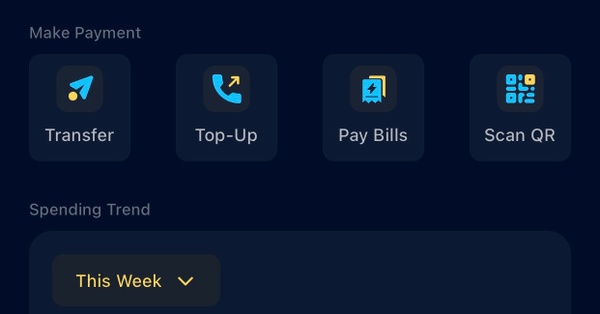

- Tap the “Pay Bills” icon.

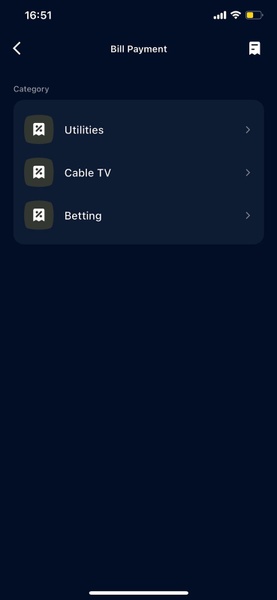

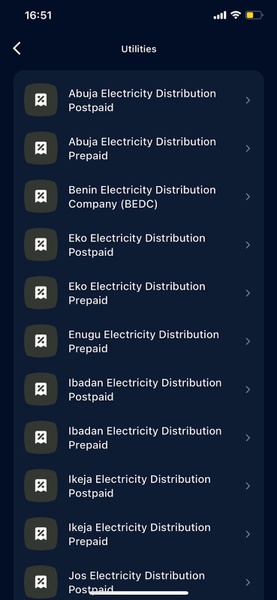

4. Select “Utilities,” and you’ll be directed to a page to choose your electricity provider.

- Enter your meter number.

- Input the amount of electricity you want to purchase. For postpaid meters, enter the bill amount from your invoice.

- Upon successful payment, you’ll receive a token for your prepaid meter. Just punch the token into your meter.

- If you’re using a postpaid meter, keep the payment proof to show the electricity company.

Why Use Moniepoint to Pay Electricity Bill?

Apart from the convenience and top-notch security, here’s why Moniepoint is the go-to platform for recharging your meter:

- User-Friendly: It’s super easy to recharge your electricity on the go using your mobile device.

- Reliable Service: Moniepoint’s platform is available 24/7, ensuring you can pay your bills at any time.

- Intuitive Interface: Even if you’re not tech-savvy, Moniepoint makes it simple for anyone to navigate.

- Safe Payments: Moniepoint’s robust security system ensures your payment details and account remain secure.

- Versatile Bill Payments: Besides electricity, you can also pay for cable TV, airtime, and more through Moniepoint.

Prepaid vs. Postpaid Meters: What's the Difference?

Usage Control

With prepaid meters, you can easily manage your electricity consumption by recharging only what you need. Postpaid meters, however, don’t offer this level of control since you’re billed at the end of the month.

Payment Process

Prepaid customers pay upfront for tokens, while postpaid customers pay after using electricity for a month.

Late Fees

Prepaid users won’t face late payment penalties since they only pay when they need more electricity. However, if they run out of tokens, their power will be cut off. Postpaid users, on the other hand, might incur late fees if they miss the payment deadline.

How to Apply for a Prepaid or Postpaid Meter

Ready to take control of your electricity usage? Here’s how to apply for a meter:

- Visit your local electricity distribution company’s website.

- Download the application form from the “Download Application Form” section.

- Fill out the form with accurate details.

- Submit the completed form to your nearest electricity office.

- Follow up to ensure your meter is delivered on time.

Final Thoughts

Taking control of your electricity usage is easier than ever with a prepaid meter. Just download the Moniepoint app from the App Store or Google Play Store, or visit www.moniepoint.com to get started today!

You Might also like

-

Card that Works

The Big Oxmox advised her not to do so, because there were thousands of bad Commas, wild Question.

-

The Right Bank for Your Small Business

How to Choose the Right Bank for Your Small Business

As a small business owner, Ade constantly makes choices that shape the success of his venture. From picking a prime location to driving sales and attracting the right foot traffic, every decision counts.

One critical yet often overlooked choice is selecting the right bank—one that offers the services and support needed to ensure smooth cash flow and foster growth.

If you’re a business owner like Ade wondering how to select the best bank for your small business, you’re in the right place. Let’s explore some essential tips and factors to keep in mind when deciding on a business bank account.

8 Tips for Selecting the Best Bank for Your Small Business

1. Understand Your Banking Needs

Before opening a business account, take a moment to evaluate your current situation and your future goals.

Think about what’s most important to your business: Do you need a loan? A business checking account? Robust online banking features? Having a clear sense of your needs will help you choose a bank that aligns with your growth plans.

2. Assess Customer Support

As your business grows, having a bank that provides reliable support is crucial. Evaluate their customer service by asking:

- Do they offer a dedicated relationship manager?

- Is support available 24/7?

- How quickly do they respond to inquiries?

- What are their operational hours?

You’ll want a banking partner you can rely on for guidance in areas like taxation, policies, and financial planning. Checking reviews from other business owners can give you insight into their level of service.

3. Review Service Fees

Banks charge varying fees for services such as transactions, overdrafts, and account management. Comparing these fees across banks can save you money in the long run.

For instance, if your business frequently uses ATMs or debit cards, opt for a bank with low or no fees in these areas. Common charges to watch out for include:

- Account maintenance fees

- ATM charges

- Transaction fees

- Inactivity penalties

- Card processing fees

The goal is to find a cost-effective banking solution that helps you manage expenses.

4. Look for Digital Banking Features

In today’s fast-paced world, being able to manage your business finances online is a must. Many banks now offer digital tools that let you handle transactions, monitor balances, pay employees, and settle bills—all from your mobile device.

Choose a bank with a user-friendly app and online platform that makes managing your finances convenient and seamless.

5. Prioritize Security and Fraud Protection

Security is non-negotiable when it comes to business banking. Opt for a bank that prioritizes safety with features like multi-factor authentication, real-time notifications, encryption, and biometrics. This ensures you can focus on your business with peace of mind.

6. Evaluate Incentives and Perks

A good bank should provide essential services such as business accounts, debit cards, and cash management tools. But some go the extra mile by offering perks like low-interest savings accounts, free consultations, or business dashboards.

Take the time to understand these offers and any associated costs before committing.

7. Access to Credit and Loans

Expanding your business often requires capital, so it’s important to choose a bank that provides easy access to credit. Look for a bank with a fair and transparent loan process tailored to your business needs.

Banks like Moniepoint MFB, for example, analyze the financial histories of their clients to offer credit that suits their specific requirements.

8. Convenience Matters

Managing a business is demanding, so convenience is key when choosing a bank. Whether you prefer digital banking or traditional in-branch services, ensure the bank fits your lifestyle.

If you frequently travel, pick a bank with widespread branches or online options to ensure seamless access wherever you are.

Enhance Your Business Banking with Moniepoint

Choosing the right bank can significantly impact the growth and efficiency of your business. The ideal bank should offer dependable customer service, streamlined transaction options, secure accounts, and other essential tools to keep your operations running smoothly.

At Moniepoint, we’re proud to partner with over two million businesses, providing access to credit, business accounts, secure debit cards, POS terminals, and more. Join us today to experience banking tailored to your business needs, anytime, anywhere.

Post Views: 186 -

7 Smart Financial Habits

7 Smart Financial Habits for Your First Paycheck

Getting your first paycheck—or a significant salary bump—is an exciting milestone. But as thrilling as it is, managing your finances wisely from the start is crucial to building a stable future. Let’s look at seven practical money habits to adopt with your first salary.

1. Track Your Expenses

Start by listing fixed monthly expenses like rent, utilities, and subscriptions. Tools like budgeting apps or even a simple notebook can help you monitor spending and stay in control.

2. Create a Budget

Use the 50-30-20 rule:

- 50% for needs (e.g., rent, groceries).

- 30% for wants (e.g., outings, hobbies).

- 20% for savings.

This balance ensures you spend wisely while setting aside funds for the future.

3. Build an Emergency Fund

Prepare for unexpected expenses by creating a safety net. Aim to save enough to cover six months of living costs. Consider keeping this fund in a high-yield savings account for added growth.

4. Pay Off Debts

If you have any debts, prioritize paying them off. Avoid unnecessary loans, and make repayment part of your financial plan to secure your future.

5. Start Investing

The earlier you invest, the better. Explore options like mutual funds or stocks that align with your risk appetite. Even small investments can grow significantly over time.

6. Use Your Disposable Income Wisely

After covering essentials and savings, enjoy the rest responsibly. Treat yourself, but avoid overspending—balance is key.

7. Plan for Retirement

Start contributing to retirement savings now. Compound interest will help your money grow, and employer-sponsored plans can boost your efforts.

Conclusion

Your first paycheck is more than just a reward—it’s a stepping stone to long-term financial health. By adopting these habits, you’ll build a foundation for stability and success.

Post Views: 217