<!-- wp:social-links --><ul class="wp-block-social-links"><!-- wp:social-link {"url":"https://gravatar.com/passionate143f97d20b","service":"gravatar","rel":"me"} /--></ul><!-- /wp:social-links -->Samuel Emmanuel

Smart Ways to Detty December

Enjoy December Without Draining Your Wallet

Hey there! 🎄 The festive season is here again, and we can almost hear that iconic Christmas jingle playing in your head. 😄

December is the perfect time to let loose, relax, and shake off the stress of the year. Maybe you’ve already planned your December groove—parties, trying that new fancy spot, shopping, binge-watching the latest hype-worthy series, heading home to see family, or even prepping for the return of your IJGB crew. If not, you’re probably mulling over a few ideas, even as the cost of living gives you side-eye.

But hey, you can still enjoy the season to the fullest without completely blowing your budget. Imagine this: you’re enjoying quality time with loved ones, feeling good about the vibes, only to find out your payment method isn’t cooperating. Yikes, right? Nobody needs that kind of buzzkill in December.

The good news? You don’t have to compromise on fun or savings.

Here’s How You Can Enjoy December Without Breaking the Bank

With a Moniepoint Verve card, you can indulge in everything the season has to offer—food, shopping, entertainment, and more—while getting rewarded with a 10% discount or cashback on select purchases every Thursday through Sunday.

Here’s the scoop:

- Food: Get discounts on Chowdeck, Sweet Sensation, and The Place.

- Groceries: Save while shopping at Addide stores and Market Square.

- Fuel: Enjoy perks at NNPC stations nationwide.

- Utilities: Save on electricity bills through BuyPower.ng.

These offers run until December 31, 2024, so you’ve got plenty of time to make the most of them.

Staying In? No Problem!

You don’t have to step out to make the season special. Use your Moniepoint Verve card for streaming on platforms like Netflix, Showmax, Spotify, and YouTube. Cook up a storm with new Christmas recipes, jam to your favorite tunes, or stock up on essentials—all while enjoying great discounts.

How to Get Your Moniepoint Verve Card

If you don’t already have one, here’s how to get started:

- Download the Moniepoint personal banking app from the Google Play Store or App Store.

- Open the app, click on ‘Cards’, and follow the simple steps.

- Sit back, and your card will be delivered to your doorstep within 48 hours.

Already have a Moniepoint Verve card? You’re all set to enjoy the festive season! Use it for your online or in-person purchases at any of the listed platforms to snag your discounts and cashback.

Go ahead and enjoy your December the smart way—with good vibes, great deals, and your finances intact.

Happy Holidays! 😊

Why Choose Moniepoint POS

Why Moniepoint POS Stands Out for Nigerian Businesses

In Nigeria’s bustling business landscape, reliable and efficient payment solutions are crucial. Moniepoint POS has emerged as a top choice for merchants and agents across the country. This device addresses common challenges such as delayed transactions, limited access to funds, and technical issues, providing a smoother experience for both businesses and their customers.

With Moniepoint POS, merchants benefit from increased profitability, seamless support, and a platform tailored to their needs. Its widespread adoption underscores its reliability and value for businesses.

Ready to take your business to the next level? Get your Moniepoint POS today and enjoy streamlined transactions with superior support! Click here to get started.

7 Smart Financial Habits

7 Smart Financial Habits for Your First Paycheck

Getting your first paycheck—or a significant salary bump—is an exciting milestone. But as thrilling as it is, managing your finances wisely from the start is crucial to building a stable future. Let’s look at seven practical money habits to adopt with your first salary.

1. Track Your Expenses

Start by listing fixed monthly expenses like rent, utilities, and subscriptions. Tools like budgeting apps or even a simple notebook can help you monitor spending and stay in control.

2. Create a Budget

Use the 50-30-20 rule:

- 50% for needs (e.g., rent, groceries).

- 30% for wants (e.g., outings, hobbies).

- 20% for savings.

This balance ensures you spend wisely while setting aside funds for the future.

3. Build an Emergency Fund

Prepare for unexpected expenses by creating a safety net. Aim to save enough to cover six months of living costs. Consider keeping this fund in a high-yield savings account for added growth.

4. Pay Off Debts

If you have any debts, prioritize paying them off. Avoid unnecessary loans, and make repayment part of your financial plan to secure your future.

5. Start Investing

The earlier you invest, the better. Explore options like mutual funds or stocks that align with your risk appetite. Even small investments can grow significantly over time.

6. Use Your Disposable Income Wisely

After covering essentials and savings, enjoy the rest responsibly. Treat yourself, but avoid overspending—balance is key.

7. Plan for Retirement

Start contributing to retirement savings now. Compound interest will help your money grow, and employer-sponsored plans can boost your efforts.

Conclusion

Your first paycheck is more than just a reward—it’s a stepping stone to long-term financial health. By adopting these habits, you’ll build a foundation for stability and success.

Increase Your Moniepoint Account Daily Limit

How to Maximize Your Moniepoint Account Daily Limit

Are you finding it difficult to send or receive more funds because you’ve reached your Moniepoint account’s daily transaction limit? We understand how frustrating that can be.

The good news? You can increase your daily or single transaction limits by upgrading your KYC (Know Your Customer) level.

These limits are in place to protect your finances, but if you need more flexibility for larger transactions, Moniepoint makes it easy to upgrade. Let’s break down the KYC levels, the limits they offer, and how to increase your account’s transaction capacity.

How to Increase Your Transaction Limit on Moniepoint Personal Banking App

To raise your daily or single transaction limits, all you need to do is upgrade your KYC level on the Moniepoint Personal Banking App. There are three KYC levels, each with its own limits and requirements:

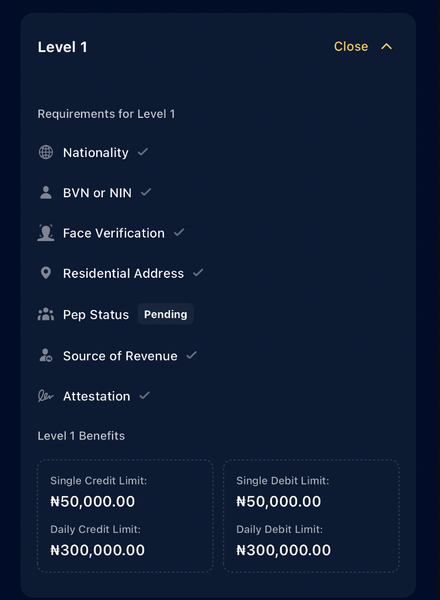

Level 1

- Limits:

- Single Credit/Debit Limit: ₦50,000

- Daily Credit/Debit Limit: ₦300,000

- Requirements:

- Nationality

- NIN or BVN

- Face Verification

- Residential Address

- Politically Exposed Person (PEP) Status

- Source of Income

- Attestation

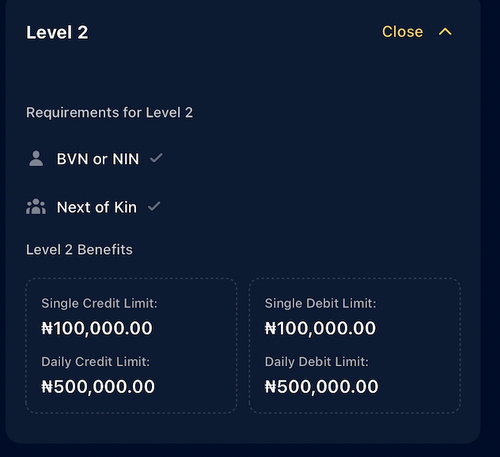

Level 2

- Limits:

- Single Credit/Debit Limit: ₦100,000

- Daily Credit/Debit Limit: ₦500,000

- Requirements:

- BVN or NIN

- Next of Kin Details

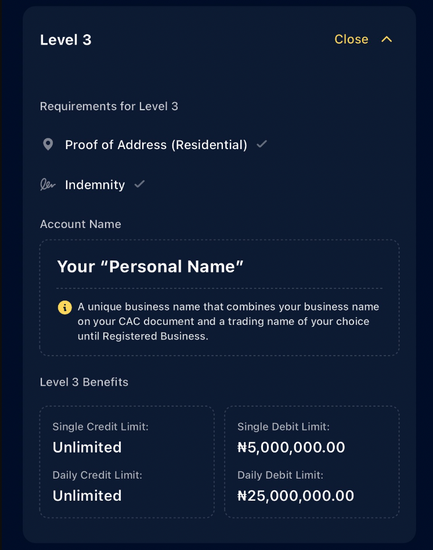

Level 3

- Limits:

- Single Credit/Debit Limit: Unlimited

- Daily Credit Limit: Unlimited

- Daily Debit Limit: ₦25,000,000

- Requirements:

- Proof of Address Verification

- Indemnity

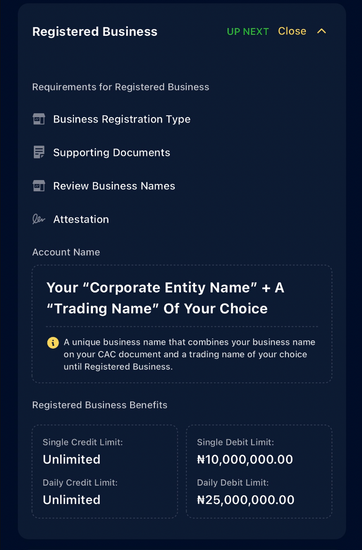

How to Increase Your Transaction Limit on Moniepoint Business Banking App

For businesses, Moniepoint offers additional KYC levels designed to help you handle larger transactions. Once you’ve completed the initial levels, you can proceed to the following two advanced levels for even greater flexibility.

Level 4 – Registered Business

- Limits:

- Single Credit/Debit Limit: Unlimited

- Daily Debit Limit: ₦25,000,000

- Requirements:

- Business Registration Type

- Supporting Documents

- Business Name Review

- Attestation

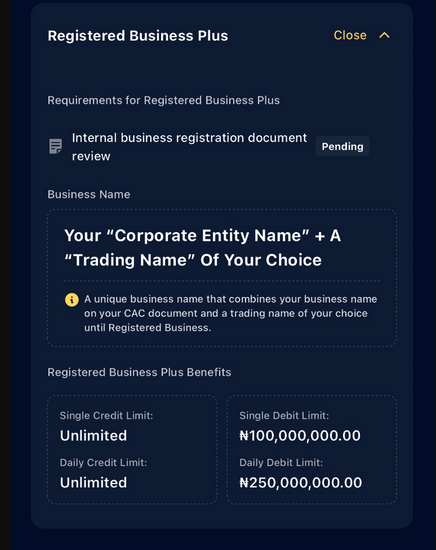

Level 5 – Registered Business Plus

- Limits:

- Single Credit/Debit Limit: Unlimited

- Daily Debit Limit: ₦250,000,000

- Requirements:

- Internal Business Registration Document Review

Why Upgrade Your KYC Level?

Upgrading your KYC level not only increases your transaction limits but also enhances your overall banking experience. It allows for smoother, more flexible transactions—whether you’re managing personal finances or running a business.

Conclusion

Upgrading your KYC level not only increases your transaction limits but also enhances your overall banking experience. It allows for smoother, more flexible transactions—whether you’re managing personal finances or running a business.

Moniepoint Facial ID

Moniepoint Facial ID: Keeping Your Account Secure

Protecting your finances in today’s digital age has never been more important. At Moniepoint, we’ve introduced a simple and powerful way to safeguard your account: Facial ID verification.

With this feature, you can secure your Moniepoint Business and Personal accounts by using your unique facial features as your key. Let’s take a closer look at how to set up Facial ID on your app and why it’s a must-have for your account.

Why Enable Moniepoint Facial ID?

Logging into your bank account with just a glance isn’t just futuristic—it’s practical! Here are the top benefits of using Facial ID verification:

1. Convenience

Tired of memorizing or typing long, complex passwords? With Facial ID, you can access your account seamlessly and carry out financial transactions without any hassle.

2. Enhanced Security

Passwords can be guessed, but your face is unique to you. Facial ID ensures that no one else can access your account, providing a secure layer of protection.

3. Faster Access

Facial ID eliminates the need to type in your login credentials, getting you into your account much faster.

How to Set Up Moniepoint Facial ID

Step 1: Download the Moniepoint App

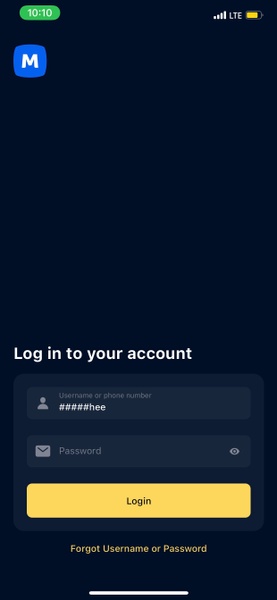

Head to the Google Play Store or Apple App Store, download the Moniepoint Business or Personal Banking app, and complete the signup process.

Step 2: Log In to Your Account

Open the app and log in using your username and password.

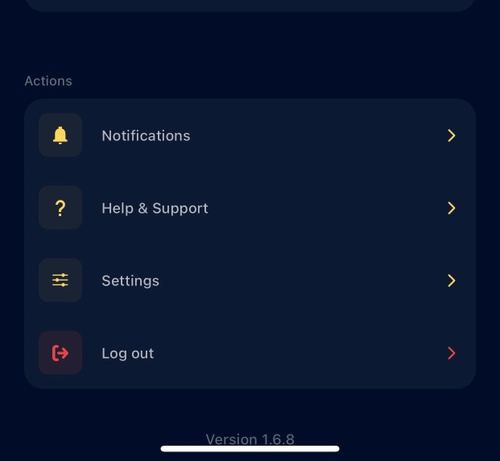

Step 3: Access Your Profile

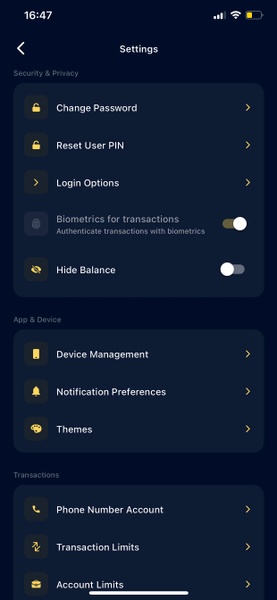

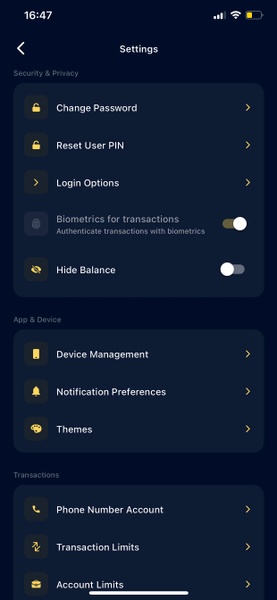

Once you’re logged in, navigate to your dashboard and click on your profile. From there, head to Settings.

Step 4: Open Login Options

Within the settings menu, find the Login Options section and click on it.

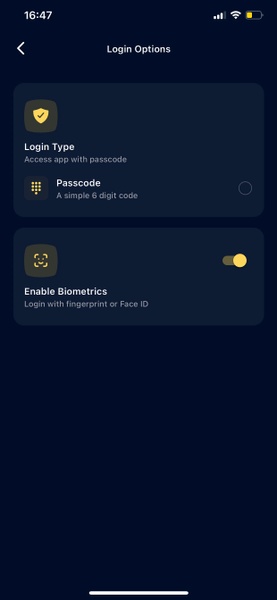

Step 5: Enable Biometrics

In the Login Options section, toggle on Enable Biometrics. When prompted, grant permission for Moniepoint to use Facial ID by clicking OK on the pop-up notification.

Step 6: Start Using Facial ID

Congratulations! Facial ID is now set up on your account. From now on, you can log in with just a glance at your device.

Final Thoughts

At Moniepoint, your security is our priority. By enabling Facial ID verification, you can protect your account while enjoying quick, convenient, and secure access to your finances.

Take control of your financial security today—follow this guide to activate Facial ID and experience stress-free banking with Moniepoint.

Get Funding for Your Business

Effective Strategies to Secure Funding for Your Business

Every successful business begins with a compelling idea—a solution designed to address specific customer needs. Whether operating as a brick-and-mortar establishment or an online enterprise, the journey of turning that idea into a thriving business often hinges on one critical factor: funding.

For many small businesses, particularly in developing regions like Nigeria, accessing the capital needed to grow and sustain operations is a significant challenge. The International Finance Corporation (IFC) estimates that about 40% of micro, small, and medium enterprises (MSMEs) in such regions face an annual funding gap of $5.2 trillion.

If you’re looking for actionable ways to secure funds for your business—be it through personal resources, loans, or alternative financing options—this guide is for you.

Identifying Your Business Funding Needs

Before seeking funding, it’s crucial to pinpoint your financial requirements. Are you at the startup stage or preparing for expansion? Clarify the purpose of the funds and create a list separating immediate needs from those that can wait. This approach will help you manage debt wisely and set realistic expectations.

Conduct a cash flow analysis to determine how much money you need to reach your next business milestone. Typical expenses to consider include:

- Payroll: Decide how many employees you need, what to pay them, and when their contributions will begin generating profits.

- Licenses, taxes, and permits: Understand regulatory requirements and budget accordingly.

- Insurance: Protect your business and employees against unforeseen events.

- Inventory: Assess and plan for adequate stock levels.

- Marketing and web presence: Allocate funds for advertisements and website maintenance to boost visibility and revenue.

- Operational costs: For physical locations, plan for rent, equipment, and utilities. Review lease terms thoroughly to avoid surprises.

Every successful business begins with a compelling idea—a solution designed to address specific customer needs. Whether operating as a brick-and-mortar establishment or an online enterprise, the journey of turning that idea into a thriving business often hinges on one critical factor: funding.

For many small businesses, particularly in developing regions like Nigeria, accessing the capital needed to grow and sustain operations is a significant challenge. The International Finance Corporation (IFC) estimates that about 40% of micro, small, and medium enterprises (MSMEs) in such regions face an annual funding gap of $5.2 trillion.

If you’re looking for actionable ways to secure funds for your business—be it through personal resources, loans, or alternative financing options—this guide is for you.

Types of Business Funding

Business financing generally falls into two categories:

Zero-Debt Financing

This involves funding your business through personal savings or investments from others, often in exchange for equity or other incentives. This option works well for startups aiming to avoid early-stage debt.Debt Financing

This entails borrowing money with a commitment to repay it along with interest. Before taking this route, ensure you have a detailed business plan, including market research, financial projections, and revenue strategies.

Practical Funding Options for Your Business

1. Personal Savings (Bootstrapping)

This approach allows you to fund your business using your personal resources. While it minimizes the risks of incurring debt, it’s most suitable for smaller-scale ventures or early-stage operations. For businesses planning to scale, additional external funding might become necessary.

2. Friends and Family Support

Borrowing from friends and family is a popular way to fund startups. Transparency is key—clearly communicate your goals and financial plans. Treat these contributions with the same professionalism as investments from external sources. Define whether the money is a loan, an equity investment, or a gift to avoid misunderstandings later.

3. Equity Financing: Venture Capital and Angel Investors

Equity financing involves exchanging a share of your business for financial support. Angel investors are more inclined to back smaller ventures, while venture capitalists typically invest in rapidly growing companies with significant revenue potential. Ensure all agreements are clearly outlined to avoid future conflicts.

4. Business Loans

For businesses unable to secure loans from traditional banks, microfinance institutions offer a viable alternative. For instance, Moniepoint provides loans tailored to small business needs, leveraging financial data and credit assessments to facilitate access to working capital.

5. Government Grants

Government bodies, such as the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN), often provide grants for business development and research. While these funds are non-repayable, the application process can be competitive and time-consuming. Be prepared with a detailed business plan and supporting documents.

6. Crowdfunding

Crowdfunding allows businesses to raise funds from a large pool of supporters. Options include:

- Equity Crowdfunding: Donors receive a share in the business.

- Rewards-Based Crowdfunding: Supporters contribute in exchange for non-monetary rewards like exclusive product access.

- Debt-Based Crowdfunding: Contributors offer loans, repaid with interest on a set schedule.

To succeed in crowdfunding, conduct market research and craft a compelling pitch that resonates with potential supporters.

Leveraging Moniepoint for Business Loans

Moniepoint simplifies the process of obtaining business loans by focusing on small enterprises’ unique financial dynamics. With flexible eligibility requirements and efficient loan processing, Moniepoint is an excellent choice for businesses needing accessible funding options.

Key Features of Moniepoint Loans

- Business loans tailored for working capital and overdrafts.

- Eligibility requires an active Moniepoint business account used consistently for at least six weeks.

- Minimal documentation: only a CAC certificate or shop rent receipt is needed in most cases.

- Quick application process with loans processed within 24–72 hours.

- Flexible loan tenures ranging from 12 to 24 weeks.

Take the Next Step

Securing funding for your business can be a challenging process, but with the right strategies and resources, it’s achievable. Whether you’re exploring personal financing, loans, or alternative funding options, understanding your financial needs and aligning them with appropriate funding sources is the key to sustainable growth.

Start today by assessing your business goals and taking advantage of opportunities like Moniepoint’s tailored financial solutions.

Why Did the Central Bank Increase the MPR?

Why Did the Central Bank Increase the MPR?

Lately, life in Nigeria has felt more expensive than ever. Prices of everyday goods and services are rising faster than anyone would like, from the cost of tomatoes at the market to the expenses of running a business. Inflation isn’t just a buzzword—it’s something affecting all of us.

To tackle this, the Central Bank of Nigeria (CBN) has stepped in with new monetary policy adjustments. If terms like MPR, CRR, and liquidity ratio make your head spin, don’t worry. This article breaks it all down, so you’ll not only understand what’s happening but also why it matters.

Here’s the gist:

- The Monetary Policy Rate (MPR) has jumped by 400 basis points from 18.75% to an all-time high of 22.75%.

- The Cash Reserve Ratio (CRR) has climbed from 32.5% to 45%.

- The Bank Liquidity Ratio remains steady at 30%.

- The Asymmetric Corridor is now set at +200/-700 basis points of the MPR.

What does all this mean for you? Let’s start by decoding these terms.

Financial Terms Explained

1. Monetary Policy Rate (MPR)

- In Simple Terms: The MPR is like the North Star for interest rates in Nigeria. It’s the rate the CBN uses to set the tone for borrowing and lending across the country. The latest increase of 400 basis points (or 4%) means higher borrowing costs.

- What It Means for You:

- Borrowing money just got pricier. Before this hike, banks charged interest rates between 25–30%. Now, it might go as high as 35%.

- On the flip side, savings accounts might start offering better returns—potentially up from 10% to 15%. That’s some silver lining for savers.

2. Cash Reserve Ratio (CRR)

- In Simple Terms: Think of the CRR as a rule that says, “Banks, keep a chunk of your money with the CBN.” Currently, 45% of all customer deposits must stay untouched in the CBN’s vaults.

- What It Means for You:

- Banks now have less money to lend, which could make it harder for people and businesses to get loans.

- On the bright side, less cash floating around can help bring down inflation by reducing spending power.

3. Bank Liquidity Ratio

- In Simple Terms: This is the cushion banks need to keep to ensure they can meet withdrawal demands. It’s like an emergency fund for banks.

- What It Means for You:

- At 30%, this rule ensures your bank is stable enough to hand over your cash when you need it.

- However, it also means banks are cautious with how much they lend out, affecting credit availability.

4. Asymmetric Corridor

- In Simple Terms: This is how the CBN controls cash flow between itself and banks, using the MPR as a baseline. If banks lend their extra cash to the CBN, they earn a lower rate (MPR – 700 basis points, or 15.75%). If they borrow from the CBN, they pay a premium (MPR + 200 basis points, or 24.75%).

- What It Means for You:

- This setup nudges banks to invest their money elsewhere—like in loans to businesses—rather than leaning on the CBN.

Why the CBN Made These Moves

Now, let’s get to the big question: why did the CBN make these adjustments?

Fighting Inflation

The primary goal is to slow down inflation. By making borrowing more expensive, both consumers and businesses are likely to spend less. Over time, this reduced spending can cool down demand for goods and services, which helps stabilize prices.

For example, a company selling bottled water might initially raise prices to cover higher loan costs. But if demand drops because fewer people are buying, the business might have to lower prices to attract customers again. It’s a chain reaction that’s been used globally to combat inflation.

Tightening the Money Supply

Raising the CRR limits the amount of cash banks have for lending. This directly reduces the money circulating in the economy, which can help control inflation.

Interestingly, some banks were already holding reserves above 45%, while others operated below the old 30% threshold. By unifying the CRR, the CBN ensures consistency across the banking sector.

Encouraging Productive Investments

Adjustments to the asymmetric corridor discourage banks from parking funds with the CBN for low returns. Instead, banks are encouraged to channel their resources into loans or investments that stimulate economic growth.

What Does This Mean for the Economy?

These changes aren’t without challenges. Borrowers will feel the pinch of higher interest rates, and accessing credit might become tougher for businesses and individuals. But the long-term goal is to create a more stable economy, where inflation is under control and money flows are balanced.

Final Thoughts

The Central Bank’s recent policy adjustments are designed to address inflation, stabilize the naira, and strengthen the banking system. While the immediate effects might be uncomfortable, these measures aim to lay the groundwork for a more resilient economy.

For more insights into finance, banking, and economic trends, visit our blog. We’re here to make the complex world of money easier to navigate.

5 Black Friday Strategies

Creative Black Friday Ideas for Small Businesses in 2024

Black Friday has become a global shopping phenomenon, with consumers spending a staggering $211.7 billion during the season in 2022. For small businesses, this is more than just a sales event—it’s a chance to capture the attention of new customers and build loyalty.

But success on Black Friday isn’t automatic. It takes more than discounts and promos to make an impact. A fast, reliable payment system and thoughtful marketing strategies are key to standing out in the crowd.

Here are five innovative ways to make Black Friday 2024 a profitable event for your business. But first, let’s touch on the history behind this shopping extravaganza.

Where Did Black Friday and Cyber Monday Begin?

The origins of Black Friday are steeped in various stories. One of the most popular explanations ties the term “black” to financial ledgers: retailers would go from losses (red ink) to profits (black ink) after Thanksgiving.

Another historical perspective traces Black Friday back to the 1950s in Philadelphia, where the day after Thanksgiving caused significant traffic congestion as shoppers flooded the city for the Army-Navy football game.

In the modern retail landscape, Black Friday refers to the Friday following Thanksgiving (November 29 in 2024), kicking off a weekend of deals that culminate in Cyber Monday, a day dedicated to online shopping.

5 Black Friday Strategies to Try This Year

1. Spark Engagement with a Contest

Contests are a fantastic way to connect with your audience while promoting your brand. You could create a simple social media challenge—ask customers to share creative ways they would use a product from your store.

Encourage participants to tag friends and engage with your page. Offer a free product or service as a prize. Not only does this build excitement, but it also drives traffic and boosts your online presence.

2. Introduce Limited-Time Deals

Time-limited offers play on the natural fear of missing out (FOMO), making them highly effective. Here’s how you can use time-based promotions to your advantage:

- Exclusive early bird discounts: Reward early shoppers with special deals to create buzz.

- Hourly sales: Keep customers coming back by introducing new discounts at different hours.

- Daily countdowns: Build momentum by offering unique deals in the days leading up to Black Friday.

- Last-minute steals: Tempt late shoppers with final offers as the clock winds down.

Use social media, email, and website banners to promote these deals with a sense of urgency.

3. Maximize Impact with Email Marketing

Email marketing is a powerful tool for Black Friday promotions. Send targeted campaigns to your subscribers featuring your best deals, gift ideas, and exclusive discounts.

Keep your emails visually appealing and include clear calls-to-action, directing recipients to shop with just a click.

4. Give Shoppers a Little Extra

Adding a freebie to each purchase is a simple yet effective way to encourage buying. Options like surprise gifts, sample products, or small complimentary items can create memorable shopping experiences.

You could also let customers choose their gift from a curated selection to make the incentive feel more personal.

5. Make Checkout Hassle-Free

A surge in Black Friday transactions can put strain on payment systems, leading to delays and frustrated customers. Offering fast, secure payment options is critical to ensuring a seamless shopping experience.

Consider tools like point-of-sale (POS) systems and reliable online payment solutions. By streamlining the checkout process, you’ll stand out from competitors who might struggle with transaction bottlenecks.

Wrapping Up

For small businesses, Black Friday is a chance to get creative and connect with customers in meaningful ways. Whether it’s through interactive contests, limited-time offers, or thoughtful customer incentives, the key is to experiment and find what resonates most with your audience.

And don’t forget—having a reliable payment solution in place can make all the difference during this busy shopping season.

Start preparing now to make Black Friday 2024 a standout event for your business!

Why Core Banking Matters

Why Core Banking Matters

Why Core Banking Matters: A Friendly Dive

Let’s rewind to the early 2000s in Nigeria. Back then, banks operated in silos—each branch was like an island. If you opened an account at one branch, you had to return there for every transaction. Frustrating, right? Enter core banking, the game-changer that united bank branches and made life so much easier.

Fast forward to 2020: Moniepoint took core banking to another level. While many fintech companies relied on prebuilt systems, Moniepoint built their own from scratch. Why? To handle billions of transactions daily with speed, trust, and reliability.

So, What Is Core Banking?

Think of core banking as the central nervous system of a bank. It handles all the behind-the-scenes operations, like updating balances, managing loans, and processing transfers. The software that powers this is called a Core Banking Application (CBA)—essentially the bank’s digital ledger. Without it, a bank simply couldn’t function.

Here’s what a CBA does:

- Manages customer data: From personal details to account types.

- Tracks transactions: Keeps an eye on every deposit, withdrawal, and transfer.

- Customizes accounts and loans: Configures different products with unique terms.

- Handles daily operations: Ensures smooth transactions and provides detailed reports.

Why Do Banks Switch Their CBAs?

Migrating to a new CBA is a big decision. Banks usually switch for reasons like:

- Cutting Costs: Relying on foreign CBAs can get expensive due to currency fluctuations.

- Scalability: Growing banks need systems that can handle more accounts and transactions.

- Innovation: New CBAs support modern features that older ones can’t.

Challenges of Switching

Migration isn’t as simple as flipping a switch. Banks must transfer massive amounts of data, test systems rigorously, and plan carefully to avoid disruptions. Timing is critical—most switches happen during off-peak hours to minimize impact. Even minor errors can create huge problems, like incorrect balances or duplicate transactions.

How Moniepoint Built Their CBA

In 2020, Moniepoint realized they needed a robust system to meet growing demands. Off-the-shelf solutions weren’t enough, so they built their own CBA using tools they knew well, like MySQL and Java Spring. They planned for growth, running tests with future traffic in mind, and adjusted quickly when actual numbers surpassed expectations.

Backup plans? Of course. Moniepoint ensured seamless operations by creating backups, simulating real-life scenarios, and even building systems that could redirect traffic to alternative providers during downtime.

Wrapping It Up

Core banking applications might not be flashy, but they’re the foundation of every smooth banking experience. At Moniepoint, their custom-built system keeps your banking stress-free, secure, and lightning-fast.

To stay informed about Moniepoint’s innovations and the evolving world of banking, make sure to visit our website. We’re always updating with insights, tools, and the latest in financial technology, ensuring you’re never left behind. Check in regularly—you’ll always find something new to learn!