Becoming A Business Owner

To Become A Moniestar, You Need To Open A Moniepoint Business Account.

Starting a business is the first step in actualising your dreams of financial freedom and becoming a household name that’s popular for providing your preferred product or service.

Yet without the right tools, no matter how much time or money you put into your business, you could end up back where you started, merely dreaming.

Of all the tools you need to make your dreams a reality, not many are as important as a business account.

What Is A Business Bank Account?

A business bank account is a type of account that companies, organizations, or individuals use to manage their financial transactions and activities.

This type of account is typically separate from personal accounts and is used for managing revenue, expenses, and other financial transactions related to running a business.

Some examples of transactions that can be made using a business account include accepting customer payments, paying bills and expenses, and transferring funds between accounts.

You can open a business account at most banks and financial institutions, and they may offer additional features such as online banking, check writing, and debit/credit cards.

What Are The Types of Business Accounts?

In Nigeria, some types of business bank accounts that banks offer include

1: Current account: This is a type of account that is mainly used for day-to-day transactions, such as accepting payments from customers and paying bills and expenses.

2: Savings account: This type of account is designed for businesses that want to save money for short-term or long-term goals.

3: Corporate account: This is a special type of account that is intended for large organizations and companies. It typically requires higher minimum deposits and may offer additional features like check writing and debit/credit cards.

4: Domiciliary account: This type of account allows businesses to hold and transact in foreign currencies, which can be helpful for businesses that trade internationally or have overseas partners.

Benefits of a Business Bank Account

You might wonder, “Why do I need a business account when I already have a personal account with my bank of choice.” Well, a business account offers a myriad of benefits for you and your business. These are:

1. Separation of Personal and Business Finances

Having a different business account helps to keep your personal and business finances separate, which can make it easier to manage your finances and prepare your taxes.

2. Professional Image

Having a business account can give your business a more professional image, which can help to attract customers and build trust with your clients.

3. Access to Banking Services

Business accounts typically offer a range of banking services such as check writing, debit/credit cards, and online banking, making it easier to manage your finances and make transactions.

4. Improved Record-Keeping

Business accounts can make it easier to keep track of your financial transactions, which can be helpful when preparing financial statements and tax returns.

5. Creditworthiness

Having a business account can help demonstrate your business’s creditworthiness, which can be important when seeking loans or other forms of financing.

6. Access to business loans

Some banks offer business loans for small-scale and large-scale businesses. Having a business account with them can make applying for and securing a business loan easier.

7. Enhanced security

Business accounts typically offer enhanced security features to protect your funds, such as fraud detection and protection services.

8. Increased credibility

Having a business account can increase the credibility of your business and help to establish trust with your customers.

Why Open A Moniepoint Business Bank Account?

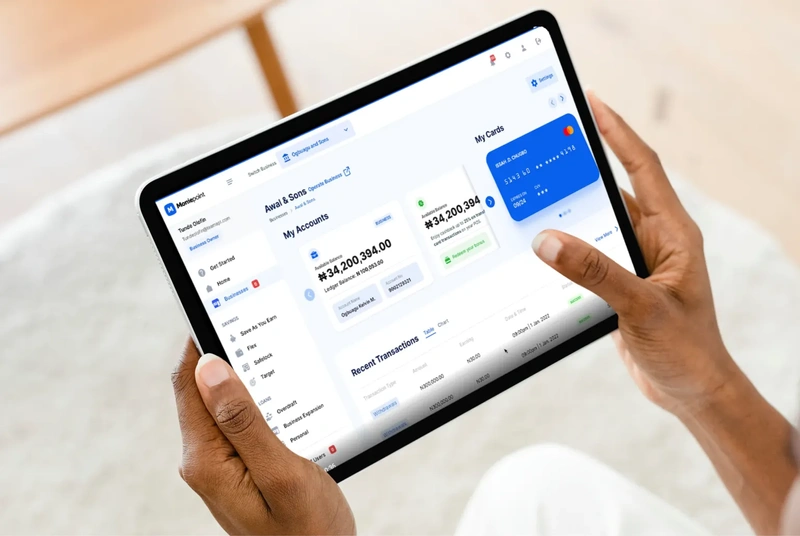

Opening a Moniepoint bank account for your business is definitely one of the smartest decisions you can make for your business.

Why? you might ask.

It’s because having a business account with us gives you access to the much-needed resources to grow your business.

The best part is you don’t need to queue in a banking hall to open a Moniepoint business account.

Besides that opening, a Moniepoint business account gives you some amazing benefits like:

- Open an account for free

- Get verified within a few minutes.

- No hidden fees

- Complete control over your account

- Round-the-clock business banking support

- Instant notifications

Requirements To Open A Business Bank Account on Moniepoint

“What do I need to open a Moniepoint Business Banking Account number?” Below are what you will require to do so:

- A functional phone number

- An email address you can easily access

- Your BVN or NIN

- A valid Government ID, e.g. International Passport, Driver’s License, and Permanent Voter’s Card. National Identification Number (NIN), Residence/Work Permit (For Foreigners)

- A utility bill to verify your address

Don’t wait! Open your Moniepoint business bank account today. gather the required details above and submit via the link below:

You Might also like

-

How to Recharge Your Prepaid Meter

The Big Oxmox advised her not to do so, because there were thousands of bad Commas, wild Question.

-

Business Registration Benefits

The Big Oxmox advised her not to do so, because there were thousands of bad Commas, wild Question.

-

How to Unblock Expense Card

The Big Oxmox advised her not to do so, because there were thousands of bad Commas, wild Question.