What is Business Banking?

Business banking encompasses the array of services that financial institutions provide specifically for businesses.

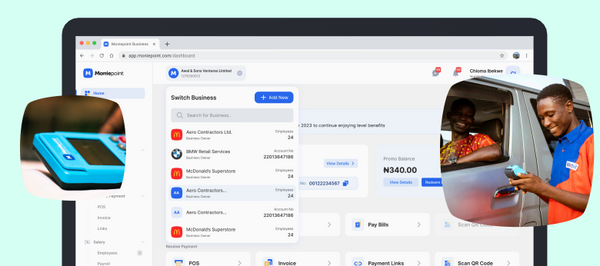

Moniepoint Business Banking

These services include loans, checking and savings accounts, credit options, financial advisory, and much more.

Key Takeaways

Financial institutions offer business banking services to help entrepreneurs effectively manage their cash flow.

Business banking provides a variety of services, including loans, savings and checking accounts, along with financial advice.

Moniepoint MFB ranks among Nigeria’s largest fintech companies, delivering business banking solutions to both small and large enterprises, including capital loans, CAC registration services, and savings and current accounts.

Nigeria hosts roughly 40 million micro, small, and medium-sized enterprises (MSMEs), with around 89.4% operating within the informal sector.

You may have just launched your dream business or been running it for a while, and your profits might be soaring.

Exciting, right? However, to ensure your earnings are safely stored or reinvested, having a business bank account is crucial.

Business banking offers numerous advantages, such as improved organization and accurate tracking of your financial transactions.

Features of Business Banking

What should you expect from a business banking service? Here are some specific characteristics of business banking:

What should you expect from a business banking service? Here are some specific characteristics of business banking:

- Business Accounts

Business banking institutions like Moniepoint MFB provide business accounts that facilitate effective cash flow management.

These accounts streamline daily operations, such as processing customer payments and purchasing goods. Additionally, business savings accounts allow you to set aside earnings for future projects or expenses.

One significant advantage of maintaining this account is the clear separation it creates between your business finances and personal funds, particularly useful during tax season.

- Business Loans and Credit

Capital is essential for any business, as access to funds promotes growth and expansion. However, acquiring financing can be challenging, especially for informal businesses. This is where business banking services from institutions like Moniepoint become invaluable.

Did you know that about 70.1% of Nigerian business owners in the informal sector rely on loans for operational expenses, often borrowing from friends and family?

Having a business bank account makes it easier to obtain loans and credit from financial institutions.

Cash Management and Employee Payroll Services

As a business owner, utilizing cash management tools provided by financial institutions helps you accurately track the inflow and outflow of your funds. Many institutions also offer payroll services that enable you to manage and compensate your employees promptly and efficiently.Payment Processing

Most businesses accept various payment methods, including debit cards and mobile payments.

Digital payments, which encompass card and mobile transfers, represent over 46.2% of the payments made by business owners in Nigeria’s informal sector.

Furthermore, business banking services include payment solutions using POS systems or payment gateways, allowing you to accept customer payments seamlessly.

- Online or Mobile Banking

In today’s digital landscape, online banking has become a necessity. Most business, commercial, and retail banks offer diverse mobile and web-based banking services that allow business owners and individuals to conveniently access financial services.

The ability to make transfers and receive payments from anywhere in the world ensures smooth business operations and growth.

Types of Business Accounts

Understanding the various types of bank accounts available will help you select the right business banking services to meet your specific needs.

- Current or Checking Account

A business checking account enables merchants to conduct everyday financial activities such as making deposits, receiving payments, and monitoring finances. Business current accounts allow for withdrawals through checks, drafts, and various online banking methods.

2. Business Savings Account

A business savings account lets you save your business funds for future investments or unforeseen expenses. You can earn interest on this account, helping you grow your cash reserves while keeping your money secure.

3. Merchant Accounts

If you sell goods or services and process debit card or online payments, you will likely need a merchant account. This account allows you to receive customer payments, which are temporarily stored in this specialized account before being transferred to your primary account after verification.

What to Consider When Choosing a Business Bank Account

When selecting a business bank account, consider the following tips:

1. The Size of Your Business

Your business size influences the type of account you should choose. Smaller businesses may benefit from a basic current bank account to minimize charges and fees. In contrast, larger businesses with higher transaction volumes might opt for accounts that offer a broader range of services.

2. Charges and Fees

Pay close attention to the service charges associated with various bank accounts, which may include monthly and per-transaction fees. It’s vital to select a bank that offers fees that align with your financial capacity.

3. Your Financial Needs

Consider your business’s specific requirements when choosing banking services. For example, does your business need check writing, debit cards, online banking capabilities, etc.?

Understanding your needs is essential for selecting a bank account that offers the necessary services and meets your business requirements.

Conclusion

Business banking is crucial for your growth as it helps you accurately track and manage your finances.

You Might also like

-

How to Recharge Your Prepaid Meter

The Big Oxmox advised her not to do so, because there were thousands of bad Commas, wild Question.

-

Business vs Company Name

The Big Oxmox advised her not to do so, because there were thousands of bad Commas, wild Question.

-

Become A Moniestar

The Big Oxmox advised her not to do so, because there were thousands of bad Commas, wild Question.