How to Maximize Your Moniepoint Account Daily Limit

Are you finding it difficult to send or receive more funds because you’ve reached your Moniepoint account’s daily transaction limit? We understand how frustrating that can be.

The good news? You can increase your daily or single transaction limits by upgrading your KYC (Know Your Customer) level.

These limits are in place to protect your finances, but if you need more flexibility for larger transactions, Moniepoint makes it easy to upgrade. Let’s break down the KYC levels, the limits they offer, and how to increase your account’s transaction capacity.

How to Increase Your Transaction Limit on Moniepoint Personal Banking App

To raise your daily or single transaction limits, all you need to do is upgrade your KYC level on the Moniepoint Personal Banking App. There are three KYC levels, each with its own limits and requirements:

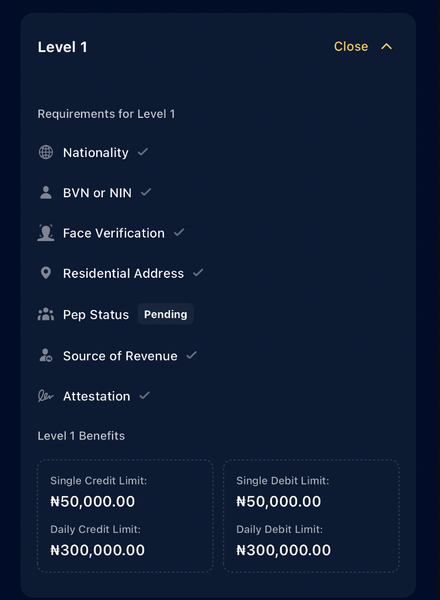

Level 1

- Limits:

- Single Credit/Debit Limit: ₦50,000

- Daily Credit/Debit Limit: ₦300,000

- Requirements:

- Nationality

- NIN or BVN

- Face Verification

- Residential Address

- Politically Exposed Person (PEP) Status

- Source of Income

- Attestation

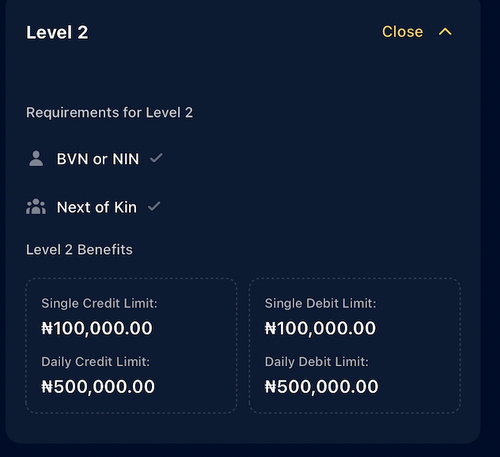

Level 2

- Limits:

- Single Credit/Debit Limit: ₦100,000

- Daily Credit/Debit Limit: ₦500,000

- Requirements:

- BVN or NIN

- Next of Kin Details

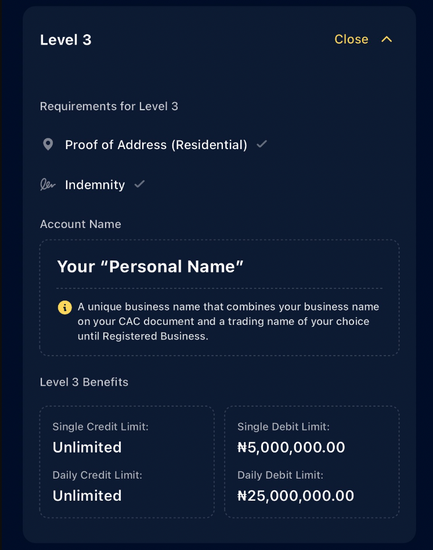

Level 3

- Limits:

- Single Credit/Debit Limit: Unlimited

- Daily Credit Limit: Unlimited

- Daily Debit Limit: ₦25,000,000

- Requirements:

- Proof of Address Verification

- Indemnity

How to Increase Your Transaction Limit on Moniepoint Business Banking App

For businesses, Moniepoint offers additional KYC levels designed to help you handle larger transactions. Once you’ve completed the initial levels, you can proceed to the following two advanced levels for even greater flexibility.

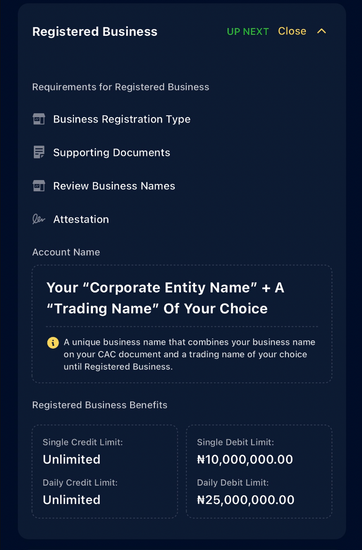

Level 4 – Registered Business

- Limits:

- Single Credit/Debit Limit: Unlimited

- Daily Debit Limit: ₦25,000,000

- Requirements:

- Business Registration Type

- Supporting Documents

- Business Name Review

- Attestation

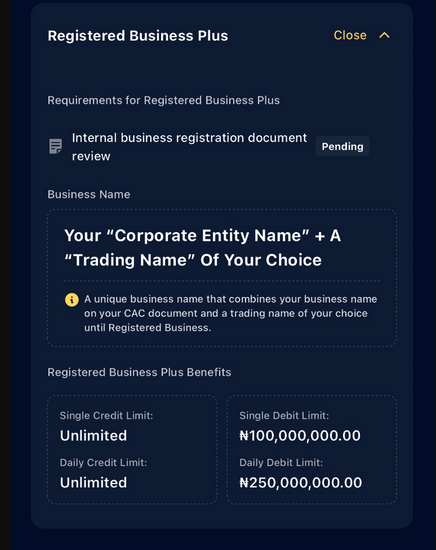

Level 5 – Registered Business Plus

- Limits:

- Single Credit/Debit Limit: Unlimited

- Daily Debit Limit: ₦250,000,000

- Requirements:

- Internal Business Registration Document Review

Why Upgrade Your KYC Level?

Upgrading your KYC level not only increases your transaction limits but also enhances your overall banking experience. It allows for smoother, more flexible transactions—whether you’re managing personal finances or running a business.

Conclusion

Upgrading your KYC level not only increases your transaction limits but also enhances your overall banking experience. It allows for smoother, more flexible transactions—whether you’re managing personal finances or running a business.

You Might also like

-

Moniepoint Facial ID

Moniepoint Facial ID: Keeping Your Account Secure

Protecting your finances in today’s digital age has never been more important. At Moniepoint, we’ve introduced a simple and powerful way to safeguard your account: Facial ID verification.

With this feature, you can secure your Moniepoint Business and Personal accounts by using your unique facial features as your key. Let’s take a closer look at how to set up Facial ID on your app and why it’s a must-have for your account.

Why Enable Moniepoint Facial ID?

Logging into your bank account with just a glance isn’t just futuristic—it’s practical! Here are the top benefits of using Facial ID verification:

1. Convenience

Tired of memorizing or typing long, complex passwords? With Facial ID, you can access your account seamlessly and carry out financial transactions without any hassle.2. Enhanced Security

Passwords can be guessed, but your face is unique to you. Facial ID ensures that no one else can access your account, providing a secure layer of protection.3. Faster Access

Facial ID eliminates the need to type in your login credentials, getting you into your account much faster.How to Set Up Moniepoint Facial ID

Step 1: Download the Moniepoint App

Head to the Google Play Store or Apple App Store, download the Moniepoint Business or Personal Banking app, and complete the signup process.

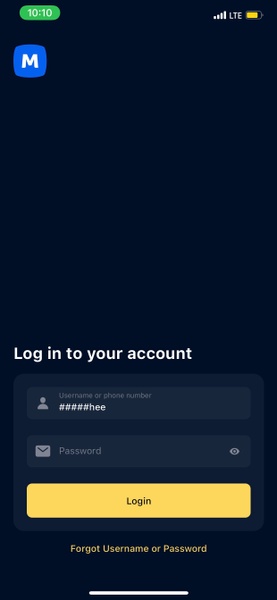

Step 2: Log In to Your Account

Open the app and log in using your username and password.

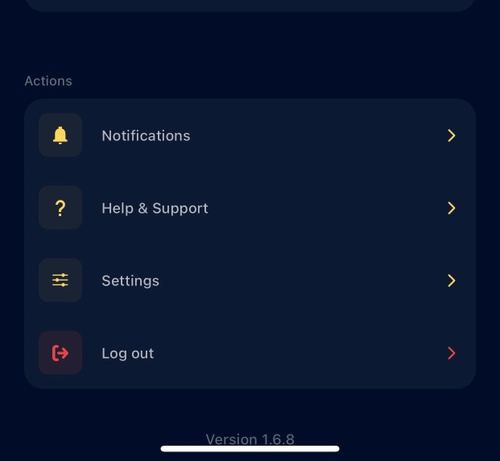

Step 3: Access Your Profile

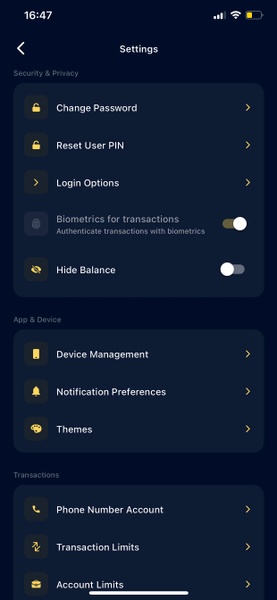

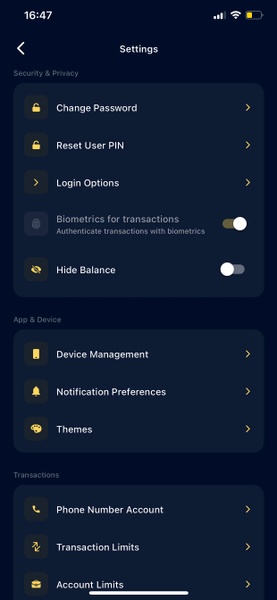

Once you’re logged in, navigate to your dashboard and click on your profile. From there, head to Settings.

Step 4: Open Login Options

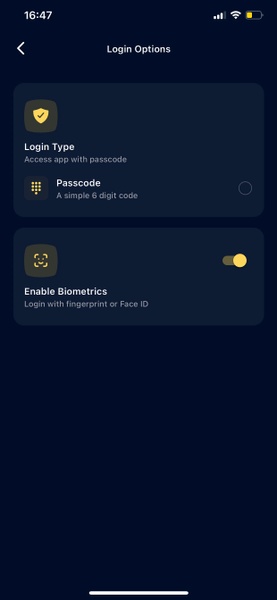

Within the settings menu, find the Login Options section and click on it.

Step 5: Enable Biometrics

In the Login Options section, toggle on Enable Biometrics. When prompted, grant permission for Moniepoint to use Facial ID by clicking OK on the pop-up notification.

Step 6: Start Using Facial ID

Congratulations! Facial ID is now set up on your account. From now on, you can log in with just a glance at your device.Final Thoughts

At Moniepoint, your security is our priority. By enabling Facial ID verification, you can protect your account while enjoying quick, convenient, and secure access to your finances.

Take control of your financial security today—follow this guide to activate Facial ID and experience stress-free banking with Moniepoint.

Post Views: 6