How to Recharge Your Prepaid Meter (2024)

Congratulations! You finally have a prepaid meter. No more headaches from those frustrating “estimated bills” that drained your wallet. With a prepaid meter, you now have total control over your electricity consumption.

Wondering how to recharge it? No worries, I’ve got you covered. In this guide, we’ll go over the easiest ways to recharge your prepaid meter, how to get one installed, and how to maximize its benefits.

One of the greatest perks of using a prepaid meter is that it lets you track your spending and make smarter financial decisions. This is especially useful in today’s economy!

How to Load Your Prepaid Meter and Pay Postpaid Electricity Bills

Recharging your prepaid or postpaid meter has never been easier, thanks to Moniepoint. Follow these simple steps to get it done:

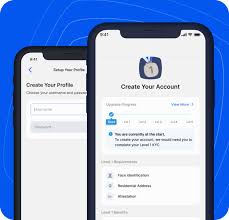

- Head over to the Google Play Store or Apple App Store and download the Moniepoint mobile app.

- After installing the app, create an account if you’re new. If you’re already a user, simply log in to your Moniepoint bank account.

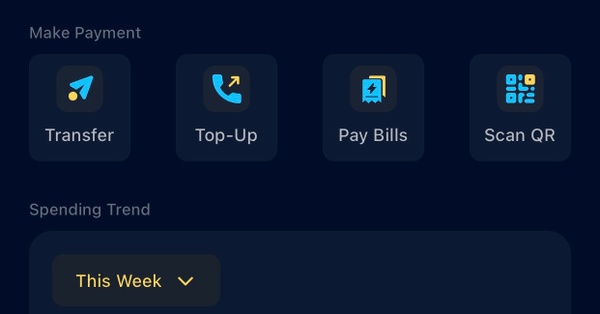

- Tap the “Pay Bills” icon.

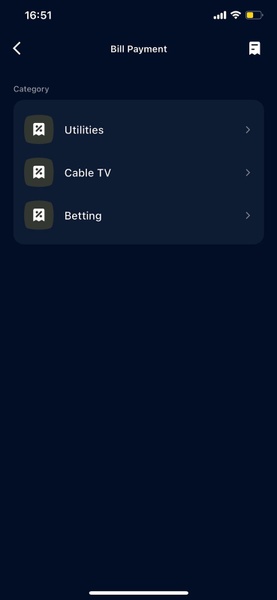

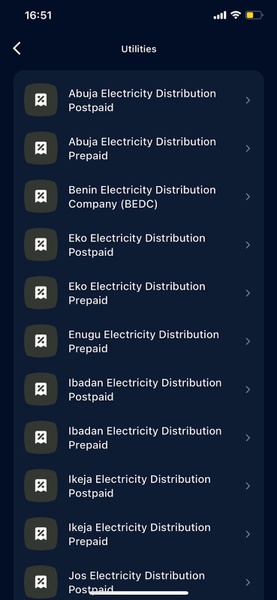

4. Select “Utilities,” and you’ll be directed to a page to choose your electricity provider.

- Enter your meter number.

- Input the amount of electricity you want to purchase. For postpaid meters, enter the bill amount from your invoice.

- Upon successful payment, you’ll receive a token for your prepaid meter. Just punch the token into your meter.

- If you’re using a postpaid meter, keep the payment proof to show the electricity company.

Why Use Moniepoint to Pay Electricity Bill?

Apart from the convenience and top-notch security, here’s why Moniepoint is the go-to platform for recharging your meter:

- User-Friendly: It’s super easy to recharge your electricity on the go using your mobile device.

- Reliable Service: Moniepoint’s platform is available 24/7, ensuring you can pay your bills at any time.

- Intuitive Interface: Even if you’re not tech-savvy, Moniepoint makes it simple for anyone to navigate.

- Safe Payments: Moniepoint’s robust security system ensures your payment details and account remain secure.

- Versatile Bill Payments: Besides electricity, you can also pay for cable TV, airtime, and more through Moniepoint.

Prepaid vs. Postpaid Meters: What's the Difference?

Usage Control

With prepaid meters, you can easily manage your electricity consumption by recharging only what you need. Postpaid meters, however, don’t offer this level of control since you’re billed at the end of the month.

Payment Process

Prepaid customers pay upfront for tokens, while postpaid customers pay after using electricity for a month.

Late Fees

Prepaid users won’t face late payment penalties since they only pay when they need more electricity. However, if they run out of tokens, their power will be cut off. Postpaid users, on the other hand, might incur late fees if they miss the payment deadline.

How to Apply for a Prepaid or Postpaid Meter

Ready to take control of your electricity usage? Here’s how to apply for a meter:

- Visit your local electricity distribution company’s website.

- Download the application form from the “Download Application Form” section.

- Fill out the form with accurate details.

- Submit the completed form to your nearest electricity office.

- Follow up to ensure your meter is delivered on time.

Final Thoughts

Taking control of your electricity usage is easier than ever with a prepaid meter. Just download the Moniepoint app from the App Store or Google Play Store, or visit www.moniepoint.com to get started today!

You Might also like

-

How to Open Moniepoint Business Account

The Big Oxmox advised her not to do so, because there were thousands of bad Commas, wild Question.

-

How to Block Expense Card

The Big Oxmox advised her not to do so, because there were thousands of bad Commas, wild Question.

-

Get Moniepoint POS

The Big Oxmox advised her not to do so, because there were thousands of bad Commas, wild Question.